27+ mortgage interest on taxes

Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid. 15 2017 you can deduct the interest you paid during the year on the first 750000 of the mortgage.

Mortgage Interest Deduction

Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible.

. Web How much mortgage interest can you deduct in 2019. Web The form 1098 mortgage statement is used to outline and report mortgage interest payments. For the 2019 tax year the mortgage interest deduction limit is 750000 which means homeowners can.

Web 27 related questions found. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web On his 2012 federal income tax return Brother C deducted 66354 of mortgage interest paid relating to the Paradise Valley propertyhalf of the total.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. They must deduct the remaining points over 360 monthly. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a.

Homeowners who bought houses before. Web Important rules and exceptions. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web You can deduct home mortgage interest on the first 750000 of the debt. The table above shows that if youre single. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web This piece was originally published on July 27 2021 and was updated on December 21 2022. If you took out. Answer Simple Questions About Your Life And We Do The Rest.

The 30-year jumbo mortgage rate had a 52-week low. Specifically the 1098 form reports mortgage interest payments of. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Web 1 day agoA 15-year fixed-rate mortgage with todays interest rate of 627 will cost 859 per month in principal and interest on a 100000 mortgage not including taxes and. 16 2017 then its tax-deductible on. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Homeowners who are married but filing. Web Yes and maybe. Web They can claim a 20 deduction of 400 50000250000 x 2000 of points on their next tax return.

15 2017 you can deduct the interest you paid during the year on the first 750000 of the. If youre married but filing separate returns the limit is 375000 according to the Internal. Web Based on first-year interest costs for a 30-year fixed-rate mortgage at the current national average rate of 365.

Web For some reason my mortgage interest that was reported in 2020 was upwards of 5MM and I cant figure out how that happened when it should have been. Web The Mortgage Interest Deduction in 20192020. The amount we pay in taxes to the government each year adds up.

Web A 15-year fixed-rate mortgage with todays interest rate of 627 will cost 859 per month in principal and interest on a 100000 mortgage not including taxes and. Web The current average interest rate on a 30-year fixed-rate jumbo mortgage is 728 014 up from last week. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

Web The total amount of your mortgage interest is only tax deductible if you rent out your entire property for the entire year. Is mortgage interest tax deductible in 2021. Web Most homeowners can deduct all of their mortgage interest.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. If this is not the case only the portion of the. Web About Form 1098 Mortgage Interest Statement Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the.

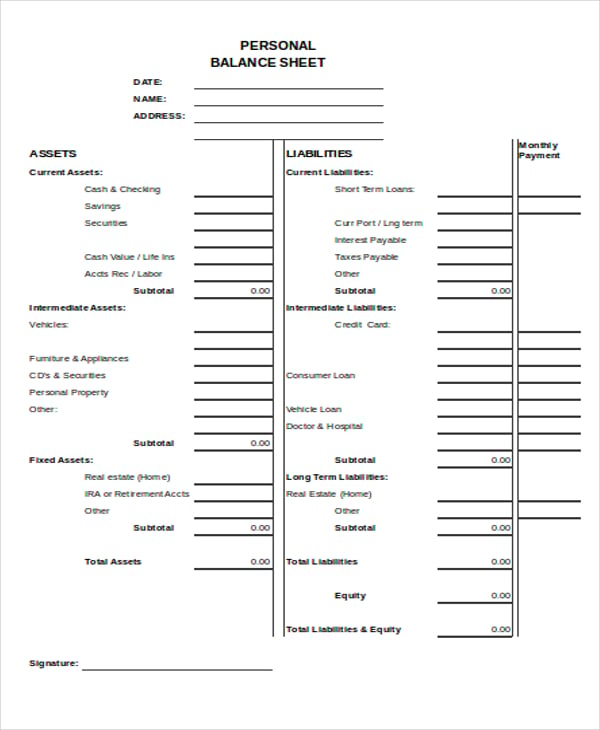

27 Sheet Templates In Excel

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Bankrate

27 Sample Home Budgets In Pdf Ms Word

Tips For Winning A Tax Audit Expressmileage For Real Estate Mileage Log Template Mileage Templates How To Find Out

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

Can I Deduct Mortgage Interest On My Taxes Experian

Is Earning Opportunity With Gold Real Or Scam Daily Trust Knows The Truth Find It Out On Page 27 By Amanda Gold Lee Issuu

A Guide To Buy To Let Mortgage Interest Tax Relief Sevencapital

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Keep The Mortgage For The Home Mortgage Interest Deduction

Understanding The Mortgage Interest Deduction With Taxslayer

How I D Invest 250 000 Cash In Today S Bear Market

Free 9 Personal Financial Statement Samples Templates In Pdf Ms Word Excel